Top 10 FMLA Employer Mistakes | Pennsylvania Employee Benefits

The Family and Medical Leave Act (FMLA) regulations that became effective in 2009 provide employers with mechanisms by which we can better curb FMLA abuse. However, there are also some traps employers can fall into if they do not review the regulations carefully and administer leave requests appropriately.

The Family and Medical Leave Act (FMLA) regulations that became effective in 2009 provide employers with mechanisms by which we can better curb FMLA abuse. However, there are also some traps employers can fall into if they do not review the regulations carefully and administer leave requests appropriately.

The following are the top 10 mistakes employers make that allow FMLA abuse and can create liability for employers:

-

Improperly Determining Eligibility: Some things to consider when determining eligibility include: employees must have worked for a covered employer, they must have worked 1,250 hours and 12 months, and they must have worked at a worksite where there are 50 employees in a 75-mile radius.

-

Deeming Employees FMLA Eligible: An employer cannot “deem” an employee eligible for FMLA if they are not eligible. An employer cannot deem an absence to be FMLA-covered if it is not.

-

Failure to Provide Required Notices: Employers have to give four notices: a general notice, eligibility notice, rights and responsibilities notice, and a designation notice. It’s important to know how and when these notices can be given.

-

Using a Calendar Year 12-month Period: An employer can choose the method by which the applicable 12-month period is measured (calendar, fixed year, measured forward or rolling backward) during which an employee is entitled to leave.

-

Failure to Calculate Leave Entitlement Appropriately: There are different regulations that determine how holidays within FMLA are treated, how much leave an employee is entitled to take based on their actual workweek, what to do if an employee’s schedule varies from week to week, and how to calculate FMLA time for an employee that was scheduled to work overtime but could not do so due to an FMLA qualifying event.

-

Failure to Properly Designate FMLA Time: Employers must designate FMLA time within five business days of determining that leave qualifies as FMLA. Employers can also track intermittent leave in the smallest increment used to track other forms of leave, provided it is not more than one hour. Special rules apply.

-

Inappropriate Use of Medical Certifications: An employer must provide an employee written notice that a certification is incomplete or insufficient. An employer can also contact the Health Care Provider for clarification or authentication, but it is important to know who can make contact.

-

Failure to Request a new Certification and Re-determine Eligibility in a new Leave Year: Once an employee is determined to be eligible for FMLA, he or she remains eligible for one year for that leave reason. It is important to know, however, what to do if an employee’s need for leave lasts beyond a year. There are steps employers can take to protect against abuse in this area.

-

Improper Use of ReCertifications: Recertification cannot be requested more often than every 30 days unless certain parameters are in place. However, regardless of the minimum duration of the condition, recertification can be requested every six months.

- Failure to Monitor Intermittent Leaves Closely: There are many things an employer can do to watch for abuse; for example, watch for patterns of absence, request recertifications as often as possible, and require employees to attempt to schedule planned medical treatment at less disruptive times.

Employers need to know the laws so they can adopt leave policies that prevent abuse while maintaining compliance.

For further information including best practices in all of the top 10 areas of FMLA mistakes, attend UBA’s webinar, “Curbing FMLA Abuse,” on Thursday, July 10, 2014, at 2:00 p.m. ET / 11:00 a.m. PT. Go to http://bit.ly/1pJqIfR and enter code UNUMUBA for a $149 discount.

The Patient-Centered Outcomes Research Institute (PCORI) fee is due July 31, 2014, for virtually all group medical plans.

The Patient-Centered Outcomes Research Institute (PCORI) fee is due July 31, 2014, for virtually all group medical plans.

By Josie Martinez, Senior Partner and General Counsel

By Josie Martinez, Senior Partner and General Counsel

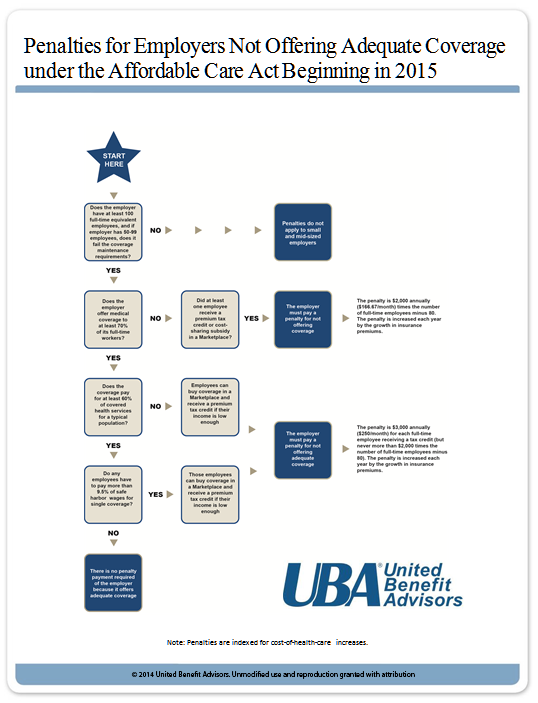

1. What must I do to avoid the employer taxes?

1. What must I do to avoid the employer taxes?

By Carol Taylor

By Carol Taylor

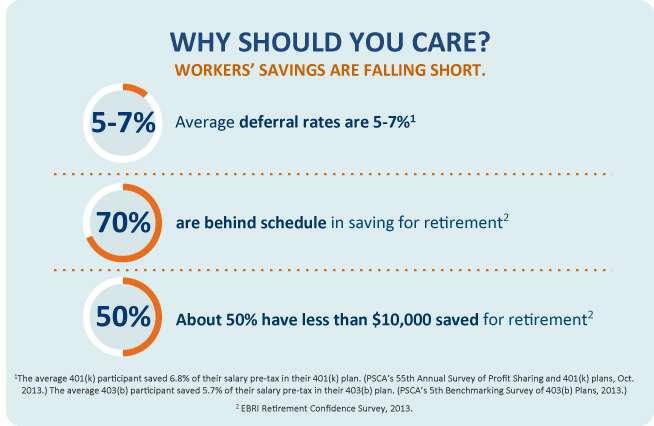

As the cost of employer-sponsored health insurance continues to rapidly outpace wages and inflation, now more than ever employers are looking for ways to keep costs down. One way to do so (that requires very modest investment) is by improving benefits communication, a critical component of employee engagement.

As the cost of employer-sponsored health insurance continues to rapidly outpace wages and inflation, now more than ever employers are looking for ways to keep costs down. One way to do so (that requires very modest investment) is by improving benefits communication, a critical component of employee engagement.