Deadline Approaching for Larger Self-Funded Health Plans To Obtain a Health Plan Identifier Number

To meet federal requirements, large health plans must obtain a national health plan identifier number (HPID) by November 5, 2014. For this requirement, a large health plan is one with more than $5 million in annual receipts. The Department of Health and Human Services (HHS) has said that since health plans do not have receipts, insured plans should look at premiums for the prior plan year and self-funded plans should look at claims paid for the prior plan year. Small health plans (those with less than $5 million in claims during the prior plan year) have until November 5, 2015, to obtain an HPID.

To meet federal requirements, large health plans must obtain a national health plan identifier number (HPID) by November 5, 2014. For this requirement, a large health plan is one with more than $5 million in annual receipts. The Department of Health and Human Services (HHS) has said that since health plans do not have receipts, insured plans should look at premiums for the prior plan year and self-funded plans should look at claims paid for the prior plan year. Small health plans (those with less than $5 million in claims during the prior plan year) have until November 5, 2015, to obtain an HPID.

Although this requirement applies to all health plans, the insurer will obtain the identifier number for fully insured plans. Self-funded plans will need to obtain the number, even if they use a third party administrator (TPA) to pay claims. Plans will be required to use HPIDs in specified HIPAA standard transactions by November 7, 2016.

“Controlling Health Plans” (CHPs) are required to obtain an HPID. “Subhealth Plans” (SHPs) may obtain an HPID. A CHP is defined as a health plan that either:

- Controls its own business activities, actions, or policies; or

- Is not controlled by an entity that is not a health plan, and if it has one or more subhealth plans, exercises sufficient control over the subhealth plan to direct its business activities, actions, or policies.

An SHP is defined as a health plan whose business activities, actions, or policies are directed by a controlling health plan.

These definitions were written with insurance companies in mind, since they will be the ones obtaining and using most of the HPIDs. Applying them to self-funded plans can be a bit confusing and HHS has not released any guidance specifically explaining how to handle multiple plans offered by a single employer. In the absence of specific instructions, a reasonable approach would seem to be to use the same approach as the employer uses with its Form 5500 filing. If an employer bundles all of its group health benefits into a single “wrap” plan and files a Form 5500 under a single plan number, the employer should probably apply for a single HPID for all self-funded benefits under the wrap plan.

Although health reimbursement arrangements (HRAs) and health flexible spending accounts (HFSAs) generally are considered group health plans, HHS has said that these plans usually will not need an HPID. An HPID is not needed for a benefit that is not considered a group health plan, such as life, disability, or a health savings account (although the related high deductible health plan will need an HPID).

An employer will apply for its HPID through the Centers for Medicare and Medicaid Services (CMS) website. Many employers will first need to register and set up a health insurance oversight system (HIOS) account at https://portal.cms.gov/wps/portal/unauthportal/home/. Note that an individual must have a login before they can register a new user account. To obtain a login, the individual must provide personally identifiable information (name, Social Security number, birthdate, home address, and primary phone number).

For more information on the HPID, download UBA’s free publication, “Deadline Approaching for Larger Self-Funded Health Plans to Obtain a Health Plan Identifier”.

CMS has prepared – and recently updated – step-by-step instructions in both graphic and text formats in its Quick Guide and it also has prepared a short YouTube video – Learn how a Controlling Health Plan can obtain a Health Plan Identifier! – that will also walk the submitter through the process. There are several steps to this process, so it cannot be completed in one session.

Detailed information is available at: http://www.cms.gov/Regulations-and-Guidance/HIPAA-Administrative-Simplification/Affordable-Care-Act/Health-Plan-Identifier.html and at http://www.cms.gov/Regulations-and-Guidance/HIPAA-Administrative-Simplification/Affordable-Care-Act/Downloads/HPOESTrainingSlidesMarchSlideDeck.pdf. Questions may be directed to HHS at HPIDquestions@noblis.org.

By Linda Rowings

By Linda Rowings

By Elizabeth Kay

By Elizabeth Kay

By Carol Taylor, Employee Benefit Advisor

By Carol Taylor, Employee Benefit Advisor

Below are some to-dos for sponsors of self-funded group health plans. The information is limited generally to the “what” and the “when.” For more details on each of the items, request UBA’s

Below are some to-dos for sponsors of self-funded group health plans. The information is limited generally to the “what” and the “when.” For more details on each of the items, request UBA’s

On September 18, 2014, the Internal Revenue Service (IRS) issued

On September 18, 2014, the Internal Revenue Service (IRS) issued

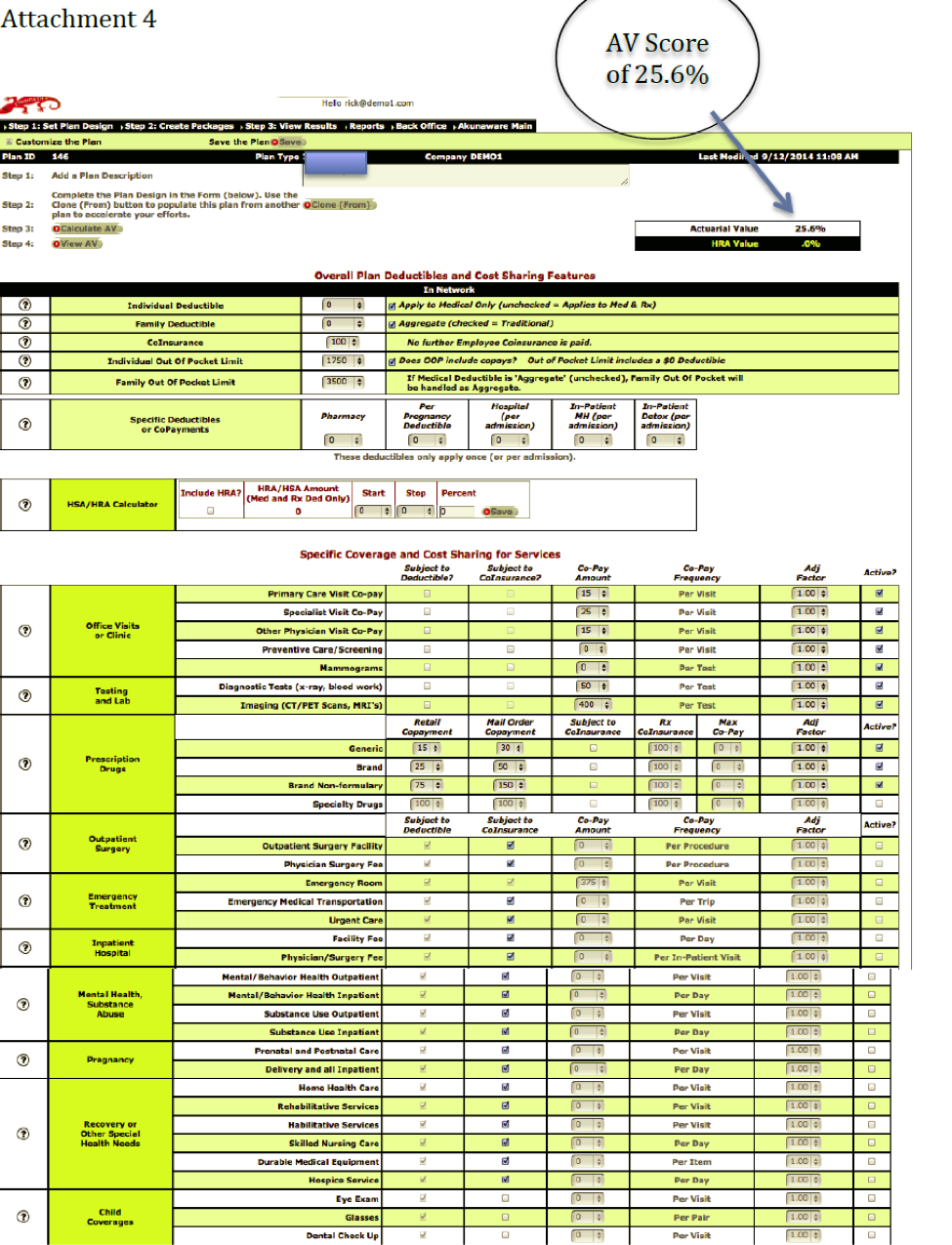

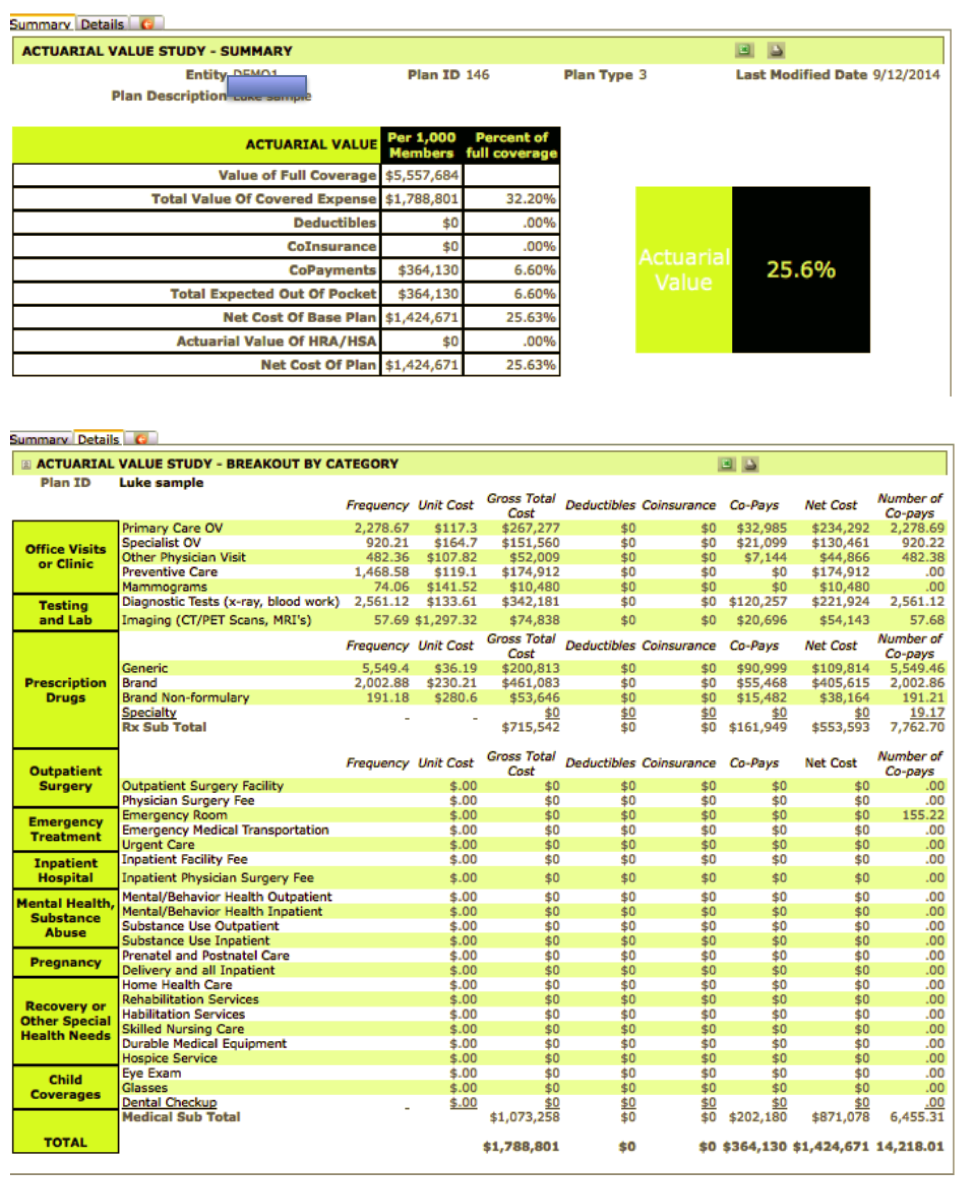

Focused provider networks (aka skinny or narrow) are nothing new to the health insurance marketplace. Insurance carriers have been using different sized provider networks in their HMO and PPO portfolios for many years now.

Focused provider networks (aka skinny or narrow) are nothing new to the health insurance marketplace. Insurance carriers have been using different sized provider networks in their HMO and PPO portfolios for many years now.

It is back to school time! Universities and colleges across the nation have dedicated time and resources to course planning and curriculum evaluation, but have they prepared for the Patient Protection and Affordable Care Act (PPACA)? Have they run the numbers, solved for unknown variables, and double-checked their answers?

It is back to school time! Universities and colleges across the nation have dedicated time and resources to course planning and curriculum evaluation, but have they prepared for the Patient Protection and Affordable Care Act (PPACA)? Have they run the numbers, solved for unknown variables, and double-checked their answers?

Communicating the value of benefits is an age-old dilemma further complicated now that many employers are making big plan changes to comply with the Patient Protection and Affordable Care Act (PPACA). As more and more employers move to high deductible health plans, making employees aware of how to use their benefits and take control of their health care consumption will be the key to cost savings. UBA’s white paper, “

Communicating the value of benefits is an age-old dilemma further complicated now that many employers are making big plan changes to comply with the Patient Protection and Affordable Care Act (PPACA). As more and more employers move to high deductible health plans, making employees aware of how to use their benefits and take control of their health care consumption will be the key to cost savings. UBA’s white paper, “