2024 BENEFIT PARAMETERS FOR MEDICARE PART D CREDITABLE COVERAGE DISCLOSURES ANNOUNCED

2024 BENEFIT PARAMETERS FOR MEDICARE PART D CREDITABLE COVERAGE DISCLOSURES ANNOUNCED

The Centers for Medicare and Medicaid Services (CMS) released a Fact Sheet announcing the 2024 benefit parameters for Medicare Part D. These factors are used to determine the actuarial value of defined standard Medicare Part D coverage under CMS guidelines.

Each year, Medicare Part D requires that employers offering prescription drug coverage to Part D eligible individuals (including active or disabled employees, retirees, COBRA participants, and beneficiaries) disclose to those individuals and CMS whether the prescription plan coverage offered is creditable or non-creditable. Creditable coverage meets or exceeds the value of defined standard Medicare Part D coverage.

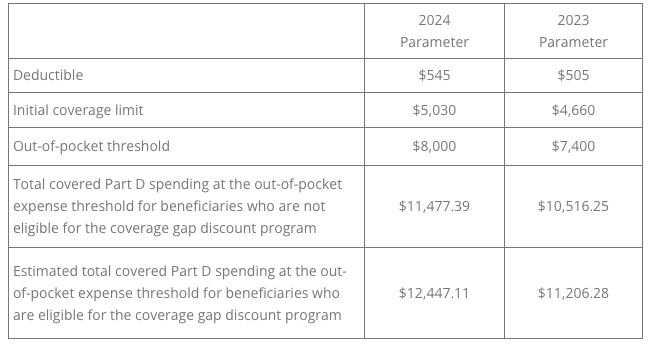

Insurance carriers and providers of the prescription benefit will typically notify the plan sponsor if their prescription plan is creditable or non-creditable. The 2024 parameters for Medicare Part D are:

The Online Disclosure to CMS Form must be submitted to CMS annually, and upon any change that affects whether the drug coverage is creditable:

- Within 60 days after the beginning date of the plan year

- Within 30 days after the termination of the prescription drug plan

- Within 30 days after any change in the creditable coverage status of the prescription drug plan

QUESTION OF THE MONTH

Q: Where can I find the updated RxDC reporting instructions?

A: The most recent version of the reporting instructions and templates can be found on the Centers for Medicare and Medicaid website.

To receive an email when the instructions are updated, create a Registration for Technical Assistance Portal (REGTAP) account. Select the checkbox “Please send me updates for the Consolidated Appropriations Act / No Surprises Act” in your account settings.

© UBA. All rights reserved.

| This information is general in nature and provided for educational purposes only. It is not intended to provide legal advice. You should not act on this information without consulting legal counsel or other knowledgeable advisors. |