In a few weeks, a second season of shared responsibility reporting will begin. For some of you, last year’s inaugural year of reporting may have felt eerily similar to Lewis Carroll’s famous book. You know the one. It included a little girl falling down a dark hole, a rabbit frantically checking his watch and a lot of other crazy characters. Now that you have the benefit of one year of reporting under your belt, let’s look at the reporting forms and try to make them less confusing by breaking them down.

In a few weeks, a second season of shared responsibility reporting will begin. For some of you, last year’s inaugural year of reporting may have felt eerily similar to Lewis Carroll’s famous book. You know the one. It included a little girl falling down a dark hole, a rabbit frantically checking his watch and a lot of other crazy characters. Now that you have the benefit of one year of reporting under your belt, let’s look at the reporting forms and try to make them less confusing by breaking them down.

Background

The Patient Protection and Affordable Care Act (PPACA), commonly called the Affordable Care Act (ACA), included various mandates to ensure all citizens have affordable coverage for health care expenses. There is a mandate at the individual level and then other mandates at the employer level.

- Individual Shared Responsibility Mandate: This mandate requires all citizens to have minimum essential coverage (MEC). If they do not, they must qualify for an exception or they will be subject to a penalty. Individuals use the 1095 forms, or a similar statement, to document that they have the required coverage.

- Employer Shared Responsibility Mandates: These mandates apply to group health plans. One requirement is that all plans that provide MEC must report who is covered by their plan. There are also requirements which only apply to employers that are considered to be an applicable large employer (ALE), which is defined as any employer that employed, on average, at least 50 full-time employees. These requirements mandate that all ALEs must provide MEC to their full-time employees and this MEC needs to be affordable. If they do not provide MEC, they could be subject to a penalty (sometimes referred to as the “A” penalty). If the MEC they provide does not meet the definition of affordable, then the ALE could be subject to a different penalty (sometimes referred to as the “B” penalty).

In general, the objective of 1094/1095 reporting is (1) to verify those individuals who had the required MEC; and, (2) to make sure ALEs are offering affordable MEC to their full-time employees. If this isn’t happening, 1094/1095 reporting provides the information necessary for the IRS to know whether a penalty to the individual, or to the ALE, is in order.

1095-B vs. 1095-C, “I don’t understand the difference!”

1095-B

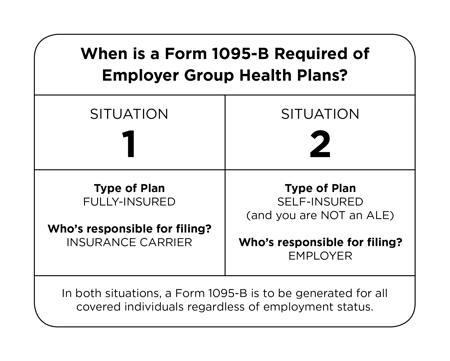

Form 1095-B provides evidence that an individual had MEC. It provides reporting strictly for the individual shared responsibility mandate. It will not trigger any employer shared responsibility penalties. It is used to provide documentation for an individual to preclude them from an individual penalty. The 1095-B is required of employer group health plans in two situations:

Situation 1: the plan is fully-insured. It is the insurance carrier’s responsibility to file the 1094/1095-B with the IRS.

Situation 2: the plan is self-insured and you are not an ALE. It is the employer’s responsibility to file with the IRS.

In these situations, a Form 1095-B is to be generated for all covered individuals regardless of employment status.

1095-C

Form 1095-C provides evidence that an ALE offered, or did not offer, affordable MEC to all full-time employees. In other words, it documents whether an ALE met the employer shared responsibility requirements. For self-insured ALEs, Form 1095-C also provides documentation that an individual had MEC, thereby meeting the individual shared responsibility requirement.

Because, in some situations, this form reports on both the employer and the individual shared responsibility mandates, it can feel nonsensical at times. To make sense, a short history lesson may be helpful.

History of Form 1095-C

When the proposed reporting regulations were first released for comment, the 1095-B was to be used for individual shared responsibility reporting and the 1095-C was to be used exclusively for employer shared responsibility reporting. As such, the 1095-C was only a two-part form with Part I being employer identification information and Part II being information on the offer of coverage that was made to full-time employees.

If the reporting forms had remained as initially proposed, self-insured ALEs would have been required to make two filings (the 1094/1095-B filing and 1094/1095-C filing). Why? Because they have a responsibility to report everyone that has MEC through their plan and they also have a responsibility to report on the offers of coverage they made to full-time employees.

Debate over this double filing requirement ensued and ultimately resulted in change. This change eliminated the double filing requirement for self-insured ALEs by revising the 1095-C. The resulting form still has Parts I and II referenced above, but it now also has Part III where employers can report the individual coverage information that was originally proposed to be reported on the 1095-B.

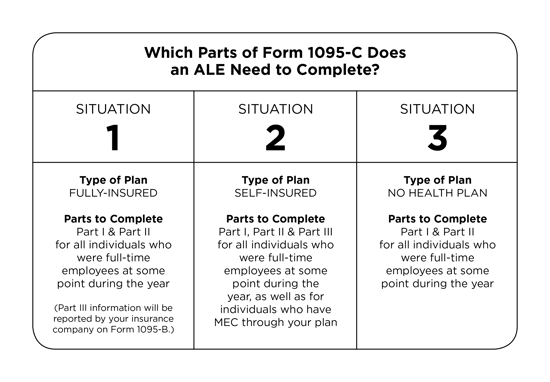

All ALEs are required to file Form 1095-C. However, which parts of the Form 1095-C you complete will be determined according to three situations as follows:

Situation 1 – Fully-insured Health Plan: You will complete Parts I and II for all individuals that were full-time employees at some point during the year. Part III information will be reported by your insurance company on Form 1095-B.

Situation 2 – Self-insured Health Plan: You will complete Parts I, II and III for all individuals that were full-time employees at some point during the year, as well as for individuals that have MEC through your plan.

Situation 3 – No Health Plan: If you are an ALE with no health plan, you will complete Parts I and II for all individuals that were full-time employees at some point during the year.

Let’s recap the 1095-C:

- The 1095-C is required of all ALEs.

- The 1095-C is a three-part form.

Part I captures employer identification information.Part II is the area used to report what offers of coverage were made and whether or not those offers were affordable. This part addresses the employer shared responsibility mandates and determines whether or not employers are at risk for an employer penalty.

Part III, which only gets completed if you have a self-insured plan, is the area used to report who had MEC through your plan. This part addresses the individual shared responsibility mandate and determines whether or not an individual is at risk for an individual penalty.

Final Thoughts

Keep in mind, if you have a self-insured plan, a Form 1095-C is required for all full-time employees, as well as anyone who had coverage through your plan, so there may be situations where you are required to produce a 1095-C for individuals that do not meet the ACA full-time employee definition that identifies those employees for whom you have an employer shared responsibility requirement. In these situations, Part II can cause concern, or an initial fear, that a penalty could be assessed because these individuals may not meet the affordability requirement. Remember, these individuals do not meet the full-time definition, therefore, they cannot trigger an employer shared responsibility penalty.

That’s 1095-B and 1095-C in a nutshell, albeit a very large nutshell. Although there are still a lot of crazy characters associated with ACA reporting, perhaps this has shed some light on the dark hole you may feel like you fell into and, hopefully, you can parlay it into a smoother reporting process in the new year. Happy reporting!

Resources

Employers that did not fulfill all of their obligations under the employer shared responsibility provision (play or pay) in regard to the 2015 plan year might owe a penalty to the IRS. In addition, employers will be notified if an employee who either was not offered coverage, or who was not offered affordable, minimum value, or minimum essential coverage, goes to the Exchange and gets a subsidy or “advance premium tax credit.” To understand this “Employer Notice Program” the appeals process, and how affordability must be documented, request UBA’s newest ACA Advisor, “IRS reporting Now What?”

UBA has created a template letter that employers may use to draft written communication to employees regarding what to expect in relation to IRS Forms 1095-B and 1095-C, and what employees should do with a form or forms they receive. The template is meant to be adjustable for each employer, and further information could be added if it is pertinent to the employer or its workforce. Employers can now request this template tool from a local UBA Partner.

Originally published by www.ubabenefits.com