As many analysts projected, premiums continue to rise, forcing many employers to manage this expanding price tag by shifting costs to their employees. As UBA reported in its breaking news, this cost shifting took the form of higher deductibles, out-of-pocket maximums, and copays for both singles and families.

According to the 2015 UBA Health Plan Survey, median in-network deductibles for singles increased 33% in the past year, while in-network deductibles for families remained unchanged. Interestingly, we observed the reverse for out-of-network deductibles, where the cost for families increased 16.7% and costs for singles remained unchanged.

Significant increases in median in-network out-of-pocket maximums are of note for both singles (14.3%) and for families (8.8%); however again for out-of-network costs, families are bearing larger dollar increases ($2,000) versus singles ($1,000).

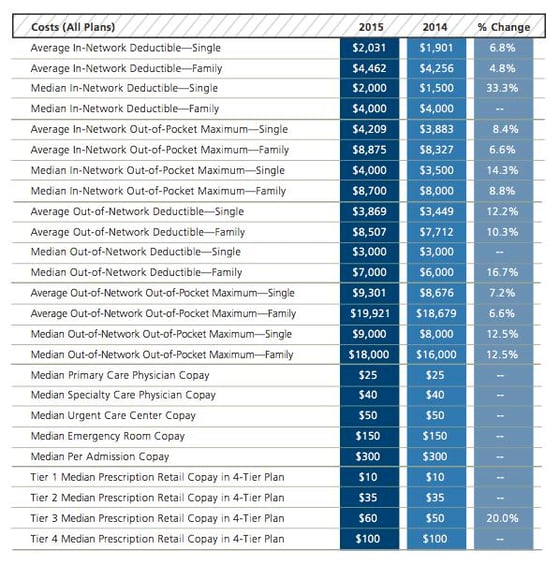

Average in-network and out-of-network deductibles, out-of-pocket maximums, copays, and prescription copays for 2014 and 2015 are as follows:

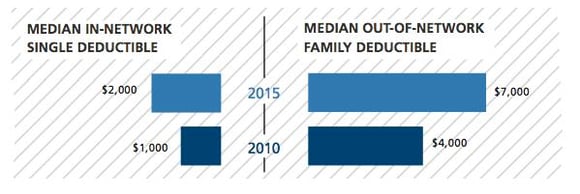

The 2015 increases in out-of-pocket and deductibles for both singles and families noted previously are indicative of the skyrocketing cost trends that we have seen over the past five years. Median in-network single deductibles have doubled, and employees’ median out-of-network deductibles increased 50%. The median in-network deductible for families increased 33% and the out-of-network deductible increase was a whopping 75% in just five years. Single employee out-of-pocket maximums for in-network increased 33% and out-of-network increased 50%, while in-network maximums for families rose 45% and out-of-network rose 50%. Because out-of-network expenses are not subject to ACA limitations, we expect to see a similar increase in costs in the future.

©2016 Copyright United Benefit Advisors. All rights reserved

©2016 Copyright United Benefit Advisors. All rights reserved

Download the UBA Health Plan Executive Summary for comprehensive findings on health plan costs.